Transfer Pricing Documentation for US-based MNCs

Transfer pricing documentation has become a crucial aspect of tax compliance for multinational corporations. This article reviews the key objectives outlined in the Organization for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines and US Internal Revenue Service (IRS) Regulations, highlighting how well-prepared documentation can simplify risk assessment and minimize IRS penalties through the “best method” analysis. Frazier & Deeter’s innovative approach to transfer pricing offers practical, cost-effective solutions while maintaining strict regulatory compliance. This overview provides essential insight for US-based multinationals facing the complexities of global transfer pricing requirements.

The Role of Robust Transfer Pricing Documentation in Mitigating IRS Penalties

If a US taxpayer is examined by the IRS and a transfer pricing adjustment is made, it may result in a tax assessment. If the adjustment exceeds a specific threshold, the IRS may assert penalties. To avoid those penalties, taxpayers can provide to the IRS, transfer pricing documentation that they prepared contemporaneously with their tax return filing.

Robust transfer pricing documentation helps to demonstrate that the taxpayer had reasonable cause for their pricing of inter-company transactions, and they acted in good faith. Taxpayers rely on their contemporaneous transfer pricing documentation during the audit process, to demonstrate that they complied with the arm’s length standard under IRC § 482. The documentation provides the basis for the reasonable cause and good faith exception to the penalty if the requirements are met.

US Tax Code Penalties for Transfer Pricing Inaccuracies

The IRC outlines various penalties that may be imposed by the IRS for transfer pricing documentation non-compliance. The primary penalty is a 20% addition to the tax penalty on the portion of tax underpayment attributable to accuracy-related misconduct. This includes negligence or disregard of rules or regulations, substantial understatement of income tax or substantial (or gross) valuation misstatement. The penalty rate may be as high as 40% under certain circumstances, including gross valuations misstatements. Further, a net adjustment penalty applies when the net § 482 transfer pricing adjustment exceeds the relevant dollar thresholds.

Objectives of Transfer Pricing Documentation

The OECD Base Erosion and Profit Shifting (BEPS) Action 13 Report identifies three main objectives of transfer pricing documentation.

- To ensure that taxpayers give appropriate consideration to transfer pricing requirements in:

- Establishing prices and other conditions for transactions between associated enterprises; and

- Reporting the income derived from such transactions in their tax returns.

- To provide tax administrations with the information necessary to conduct an informed transfer pricing risk assessment and selection of cases for audit.

- To provide tax administrations with information necessary to conduct an audit of the transfer pricing of entities subject to tax in their jurisdiction.

As part of the process of complying with reporting obligations, taxpayers may also be incentivized to focus attention on their transfer pricing arrangements and their compliance with transfer pricing rules. By preparing transfer pricing documentation, taxpayers can place themselves in a better position to defend their transfer pricing policies in the event of an audit by the tax authorities. For tax administrations, the contemporaneous transfer pricing documentation will help to ensure the integrity of the taxpayer’s position.

Role of Transfer Pricing Documentation in Efficient Risk Assessment

Transfer pricing reports that comprehensively document the reasonable selection and application of a transfer pricing method help demonstrate low levels of compliance risk. This, in turn, helps support early deselection of the transfer pricing issue from further examination. High-quality transfer pricing documentation allows the examining agent to rely on the taxpayer’s analysis of functions, risks, intangibles and value drivers. This saves time for both the taxpayer and the IRS in examining low-risk transfer pricing issues. Overall, robust transfer pricing documentation facilitates efficient transfer pricing risk assessments and examinations for both taxpayers and examiners.

Frazier & Deeter’s Approach to Transfer Pricing Documentation

We believe that transfer pricing compliance documentation should follow a robust and practical approach. Only the mandatory information required by the tax regulations should be maintained, with minimal administrative and cost impact on the business.

To achieve this objective, we have developed FD’s Transfer Pricing Documentation Compliance Toolkit with the following features.

Time-efficient Functional Analysis Documentation Checklist

Our team of industry experts has developed a standardised information checklist that can address the mandatory sections of the transfer pricing documentation. It typically only requires a time investment of around 2 to 4 hours from the client’s team (including business, finance and tax teams), to gather the transfer pricing compliance-related information.

Pragmatic Approach to Benchmark Analysis

We adopt a pragmatic approach to benchmarking analyses by focusing on functional comparability and producing cost-effective benchmarking analyses using an extended team of offshore benchmarking specialists. We pass on the benefits of the cost savings from our offshore benchmarking model to our clients, whilst ensuring centralised quality review. The standard large sample industry benchmark reports, which are cost-efficient, may be adopted by clients based on the evaluation of potential audit risk and the materiality of the inter-company transactions.

Executive Management Styled Transfer Pricing Documentation Reports

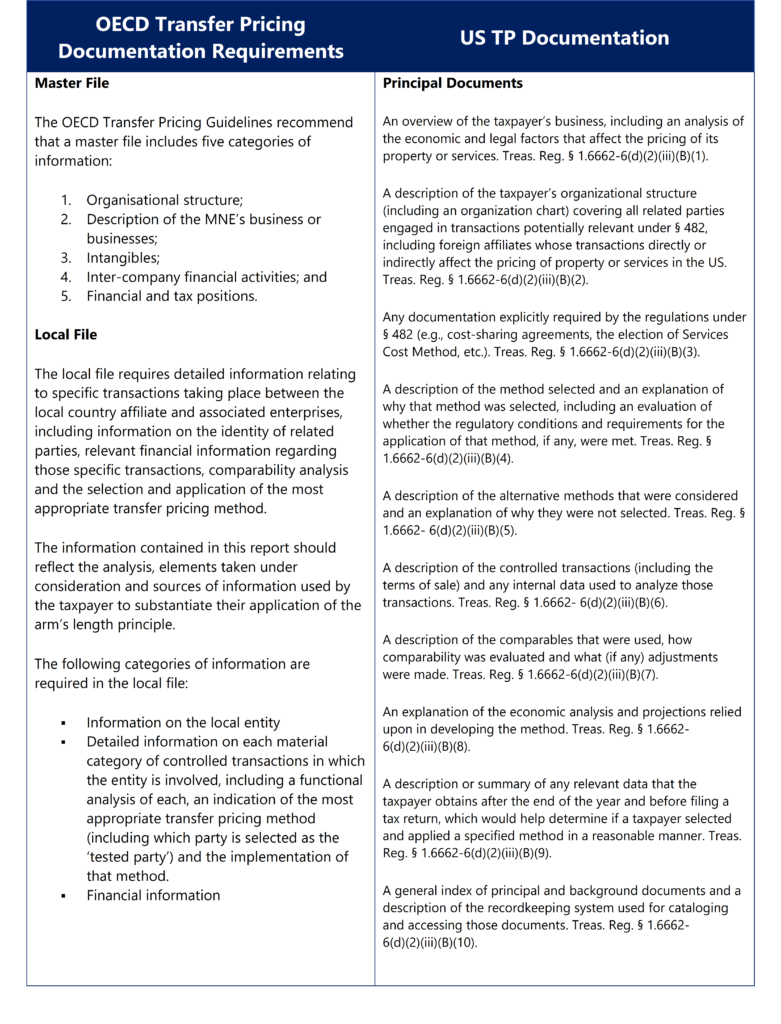

The sections of the toolkit will cover the mandatory sections required by IRC § 482 regulations, along with the additional sections required under the OECD guidelines on Master File and Local File (largely adopted by most non-US jurisdictions).

Transfer Pricing Agreements

Every business faces risks. From a transfer pricing perspective, risks must be identified and then allocated between the headquarters company and the other group entities. The US IRS recommends that Inter-company Agreements are maintained, which clarify how the assignment of rights and responsibilities between the parties are established and how risks are allocated. Our transfer pricing team can assist with drafting transfer pricing Inter-company Agreement templates for the business to execute, in relation to meeting the standards for robust TP documentation compliance requirements both in the US and in other jurisdictions.

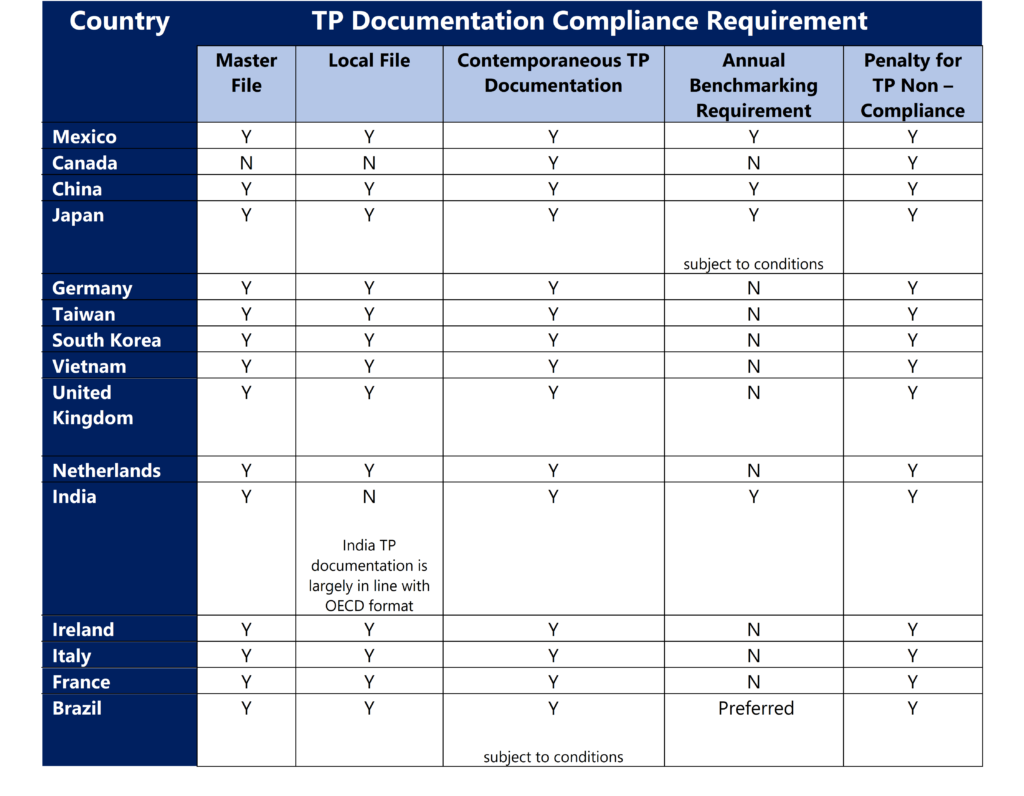

Transfer Pricing Documentation Compliance Requirements

Top 15 US Trading Partner Countries & Their Transfer Pricing Compliance Requirements

Contributors

Malcolm Joy, UK Office Managing Partner

Partner, Frazier & Deeter Advisory, LLC

Jaydeep Menon, National Office Leader, FD India

Partner, Frazier & Deeter Advisory, LLC

Explore related insights

-

Corporate Carve-Outs Done Right

Read more: Corporate Carve-Outs Done Right

-

Treasury Secretary Explains Vision for IRS at Committee Hearing

Read more: Treasury Secretary Explains Vision for IRS at Committee Hearing